New Delhi: Time and again it has been reiterated that starting early is key to a strong financial foundation. But when to start, how much to start to get a robust return on retirement has several factors in play.

Among a host of essentials, two things that matter most is your financial goal and the age at which you want to kick start your investments. Although starting early always has its benefits, one should, however not refrain from investing in future plans, thinking they haven't started early.

FundsIndia’s Wealth Conversation Report for the month of July 2025 has shared some interesting investment insights, stating that even a small amount invested early, makes a huge difference over a long time frame.

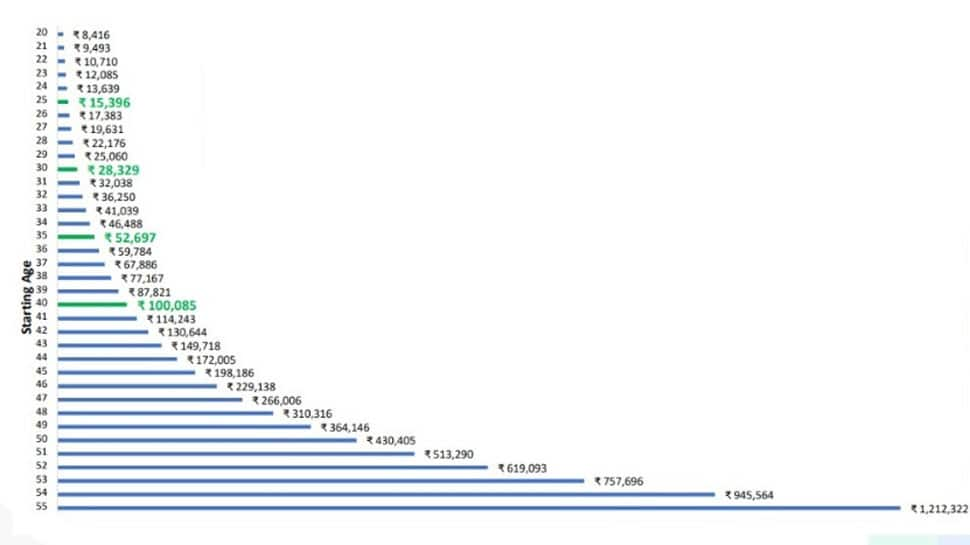

Monthly SIP Amount Required to Reach 10 crore at 60 years (@12% returns per annum)

As per FundsIndia’s report says that the following monthly SIP amount is required to reach Rs 10 crore at 60 years (@12% returns per annum).

If you start investing via SIP at the age of 25, the monthly SIP required is only Rs 15,000

But if you delay and start at the age of 30 the monthly SIP required is 2 times more at Rs 28,000

If you delay and start at the age of 40 the monthly SIP required is 6 times more at Rs 1,00,000

Source: FundsIndia Research

It mentions that Rs 1 lakh invested (assuming 12% per annum returns) at the age of 20, grows upto 100 times to Rs 1 crore when you reach 60 years. With a 10 years delay, i.e at the age of 30, your fund grows only 30 times to Rs 30 lakhs when you reach 60 years while for a 20 years delay i.e at the age of 40 your fund grows only 10 times to Rs 10 lakhs when you reach 60 years.

(The article is for informational purpose only and should not be construed as an investment guide.)

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.